Risk:Resolve®

ERM for Higher Education.

Difficult to Implement and Sustain.

How much risk can your institution realistically manage given the impediments it faces?

ERM for Higher Education -- A Practical Approach

Your institution should begin this journey toward an ERM for Higher Education process with an unbiased, analytical assessment of where it presently stands.

Senior leadership should seek answers to questions such as these:

EVALUATE.

How is risk evaluated presently?

Who starts the evaluation?

Who takes part in the evaluation?

COLLABORATE.

Is collaboration across silos encouraged?

Does collaboration take place?

How do you know that collaboration is taking place and that it is being done in a meaningful manner?

MITIGATE.

Who decides what sort of mitigation is called for?

How is risk mitigation funded?

How is progress toward risk mitigation goals measured?

Who measures mitigation progress?

Think about these things as your institution prepares its journey toward an ERM for Higher Education process.

Two important questions:

(1) How interested is your institution’s senior leadership team in developing an ERM for Higher Education process?

(2) Given the impediments your institution faces, what level of ERM for Higher Education can it realistically reach?

Note: Refer to the twelve levels of Risk:Resolve® ERM for Higher Education Process listed on Home Page of this website as a guide to the level your institution can realistically reach.

Impediments to launching and sustaining an ERM for Higher Education process.

Here are some impediments your institution may be dealing with presently. Other impediments may reveal themselves as you embark upon this journey.

- Administrator / staff indifference, “not my job” mentality

- Compartmentalized thinking

- Difficulties in overseeing work due to highly decentralized organizational structure

- Fear of getting locked in to endless, unproductive meetings

- Lack of resources to address risk

- Lack of support, commitment, or engagement by senior leadership and the governing board

- Personalities

- Politics

- Power differentials

- Rushed risk evaluations rather than reasoned risk evaluations

- Unwillingness to breach silo boundaries

How we help with implementing and sustaining an ERM for Higher Education process.

We will make sure everyone involved in the process understands what is expected of them.

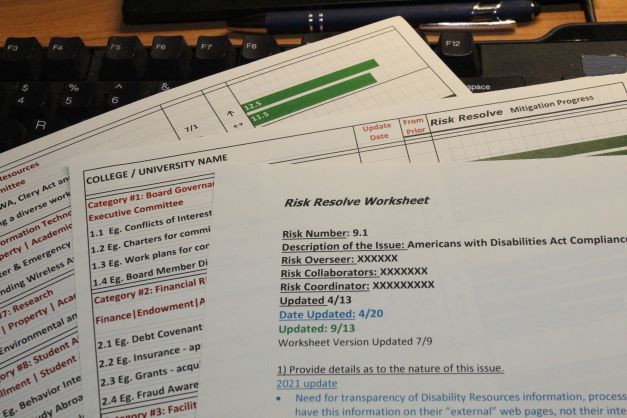

Risk:Resolve® Worksheets

ERM for Higher Education requires collaboration.

What's the difference between "traditional" risk management and "enterprise"risk management.

Let's use a campus parking lot to illustrate the difference. From a traditional risk management perspective (the kind everyone is familiar with), the concern would be about the loss potential from potholes, lack of directional signage, broken or missing guardrails, and so forth.The loss potential of concern is FINANCIAL. It is the need to defer maintenance. It is the fear of lawsuits arising out of accidents or injuries to third-parties. It is the risk of financial loss resulting from the institution's failure to address hazards. The most likely question would be: Do we have coverage for this? Whereas from an enterprise risk management perspective, the focus is on STRATEGIC and OPERATIONAL concerns and the questions are much broader. Questions such as: "Does the placement of this parking lot align with the institution's campus facilities master plan? Does its placement enhance the "campus experience" for residents, visitors, and neighbors? Is this parking lot in a place where it enhances safety or does it's location encourage criminal activity? Does it's existence increase the risk of sexual assaults given its poor lighting and blind spots? Will the renovation or replacement of this parking lot represent a best use of the institution's limited resources?

Why the emphasis on collaboration in enterprise risk management?

Continuing with this parking lot example, it's easy to see how something viewed as a single silo risk issue (Facilities in this case) could also be viewed as an enterprise risk issue, depending on one's perspective and intentions. Parking lot repair or replacement considerations, which in this case resulted from extended deferred maintenance, will now require multiple silos to collaborate, evaluate, and mitigate the risk. Collaboration across silos is essential for mitigating enterprise risk in higher education settings.

How is mitigation different with enterprise risk management?

With traditional risk management the goal is to reduce financial uncertainty. This usually involves purchasing insurance. In some cases it may also involve transferring the institution's financial risk to some third party. With enterprise risk management the focus is on strategic and operational risk and how they could potentially impact or impair the institution's mission.

Risk:Resolve® templates, worksheets, and guidance assist the institution in launching and improving its ERM for Higher Education process.

Traditional risk management asks:

Will our insurance cover that?

Can we get insurance to cover that?

Can we limit our liability by transferring

the risk to someone else?

CONVENTIONAL WISDOM.

Buying insurance is resolving risk.

Not true. Buying insurance in no way changes the characteristics of the risk itself.

Risk mitigation services are part of your insurance program.

In fact, “loss control” or “risk control” is part of your insurance program. It is principally for the benefit of the insurance company. The fewer losses incurred by you the more profit the insurance company makes.

Insurance brokers offer “added value” insurance services.

Some do. Some do not. Consider this: “Added value” does not mean free, nor does it mean that the services provided are by an expert who works exclusively with institutions of higher education.

And what are they offering, really? The broker’s (or insurance company’s) expert does an assessment and hands the institution a list of “to do’s.” Who gets to do the “to do’s?” You do! Sometimes these risk improvement “recommendations” come with a demand that the improvements be completed within an unreasonable time-frame under threat of policy cancellation by the insurance company for failure to complete the “improvements” within the designated time-frame.

Insurance broker compensation is representative of their service level.

Insurance broker compensation can be either commission included in the premium you pay to the insurance company, or broker fees charged directly to you by the broker.

Insurance broker compensation, whether commission or broker fee, is calculated based on the total premium paid by the institution to its insurance companies. Broker compensation can be anywhere from 5% to 15% of the total premium. It is a function of what the market will bear, not the level of service provided to you.

Your institution may not be receiving benefits beyond what the insurance companies are obligated to offer under the insurance contract (i.e., policy). Whether those services are commensurate with the amount of money you are paying to the broker for their services, is something for you to decide.

BEYOND CONVENTIONAL WISDOM

Both your broker and their insurance companies expect your institution to manage risk. They will not do it for you! In fact, one of their underwriting qualifiers in offering your institution insurance is that you actively manage risk.

Keep in mind, the problems of most consequence for colleges and universities are those with longer time horizons, often with little or no immediate impact, and for which insurance is far too expensive or is not available at any price. ENTERPRISE RISK IS IN THIS CATEGORY. Colleges and universities tend to defer action on these issues. Deferring enterprise risk management evaluation, collaboration, and mitigation action puts the solvency and long-term viability of the institution at risk.